Table of Content

Department of Agriculture standards, but you should still be prepared to meet the minimum set by lenders, usually 640. You may improve your chances of qualifying for a rental with a low credit score by offering a higher deposit or getting a co-signer. Landlords don’t generally report your rent payments to credit bureaus, but they can sign up for services that track and report on-time payments. You’ll have a better chance of getting a conventional loan if you meet the requirements set by Fannie Mae or Freddie Mac. These government-sponsored enterprises buy qualifying loans from lenders.

Our partners cannot pay us to guarantee favorable reviews of their products or services. If you qualify for one of these loan types, you may be able to make a smaller down payment, too. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you.

Why Were You Turned Down for a Loan?

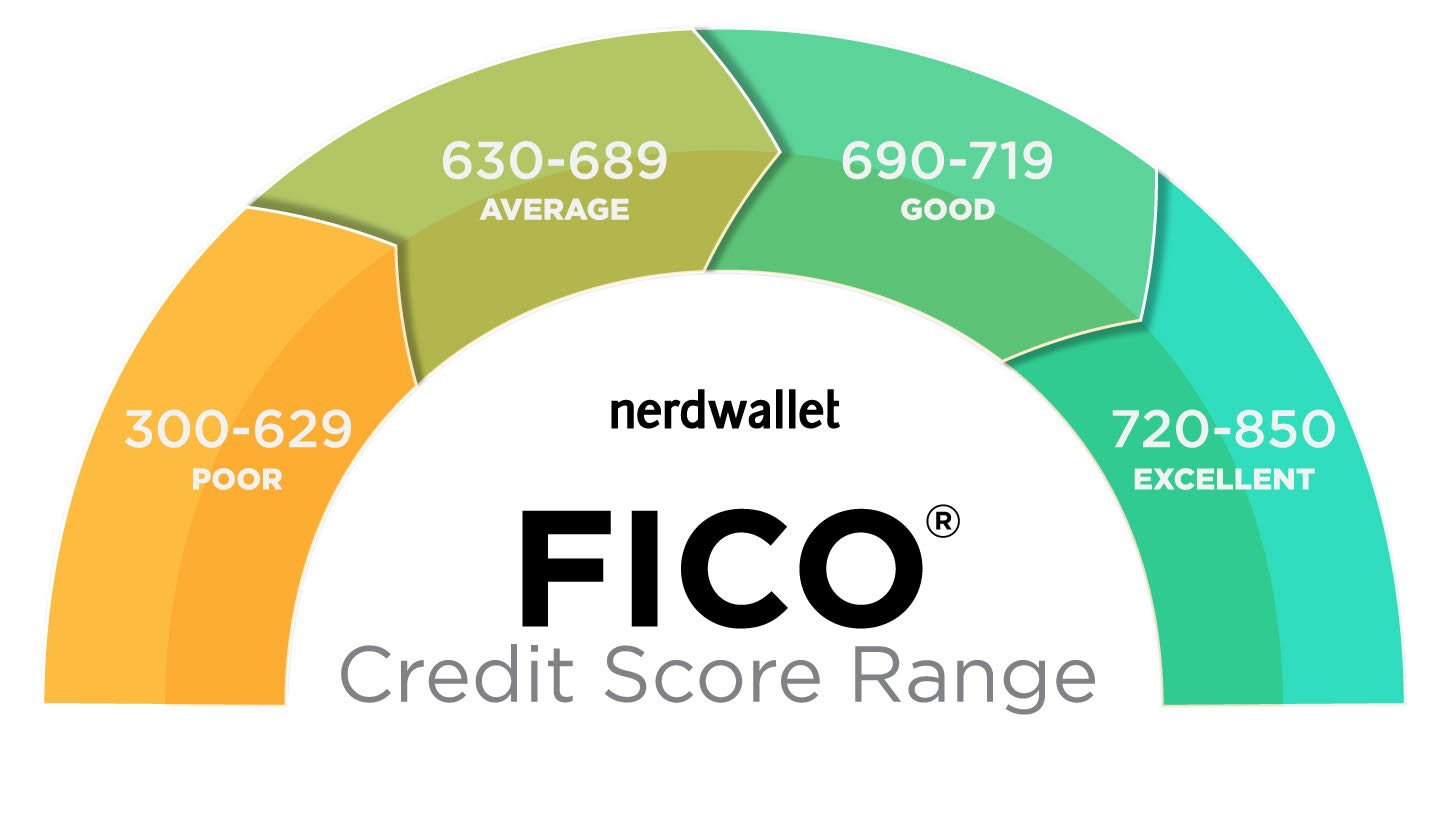

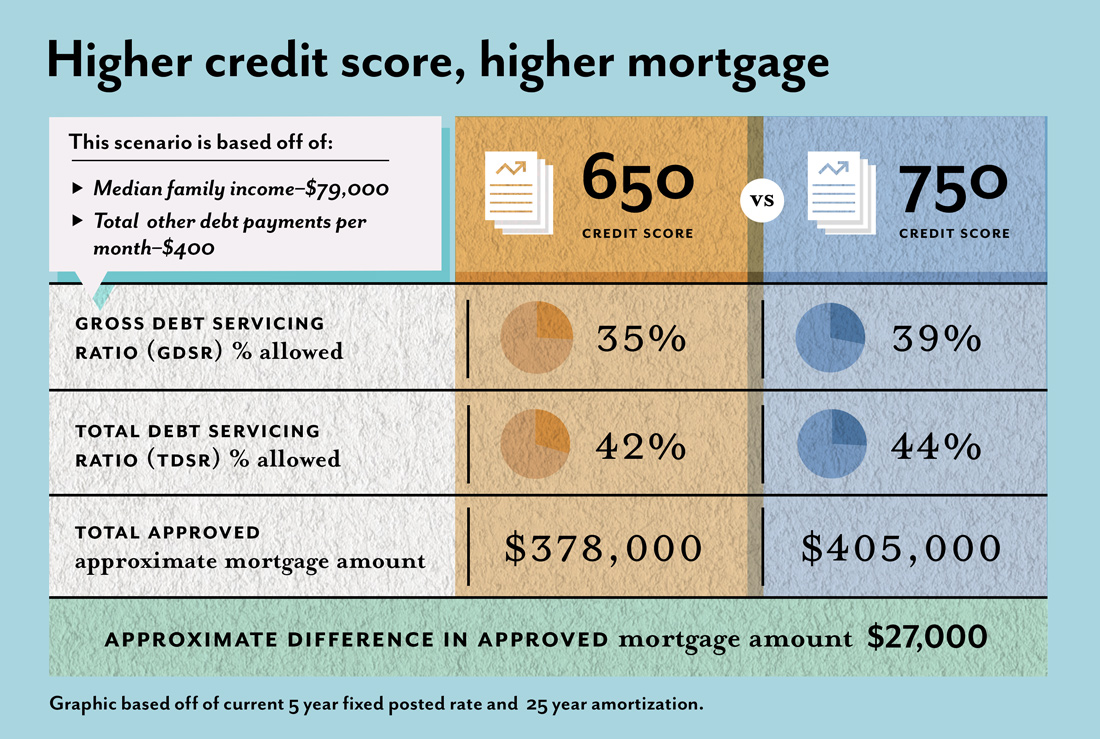

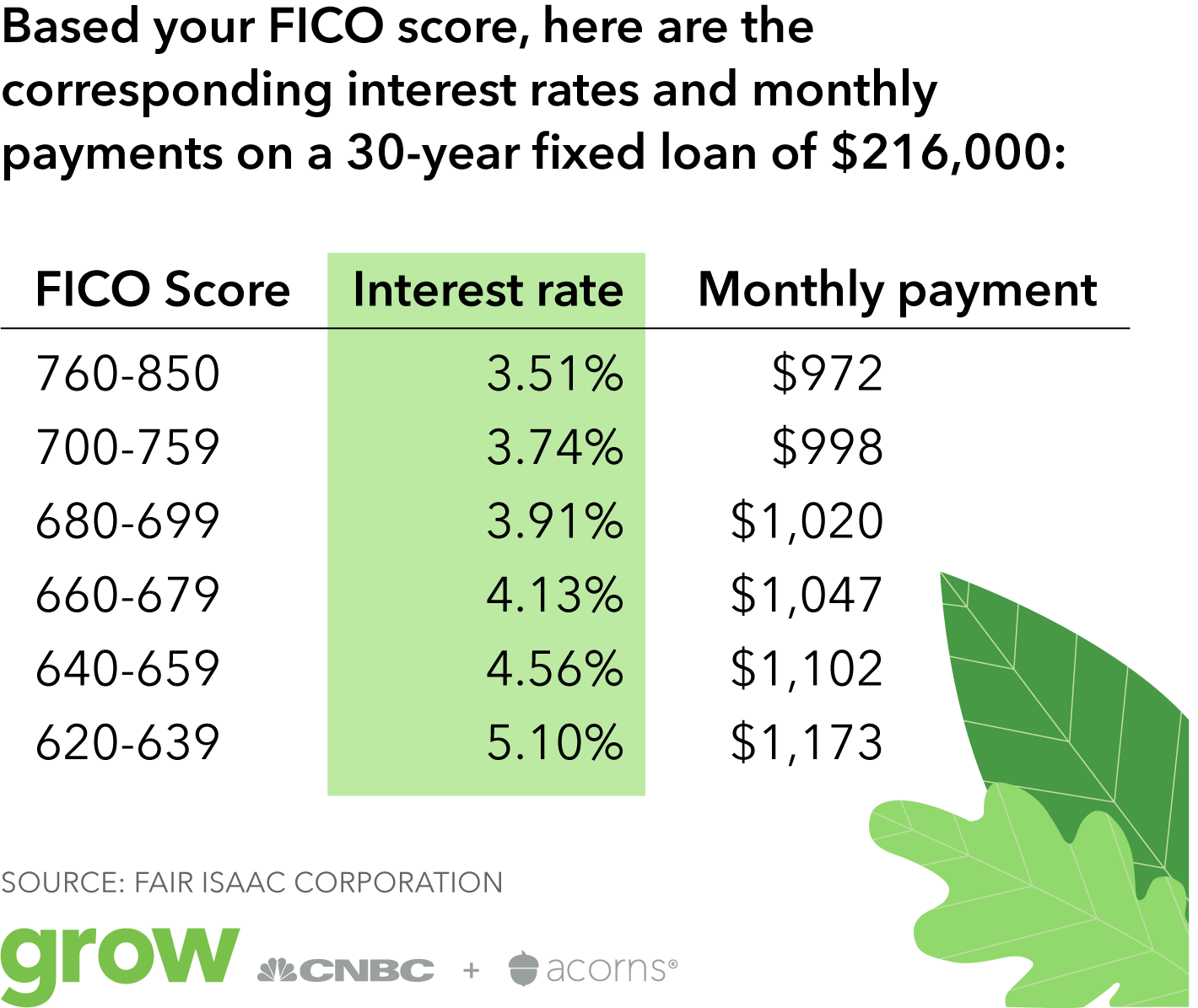

The higher your score, the more lenders will want to work with you. Though higher credit scores are considered more favorable for lenders, it’s still possible to get a mortgage with less-than-ideal credit. Conventional and government-backed loans have different credit score requirements. Improving your credit score can help you qualify for better mortgage rates. Start by getting current on any past due accounts, if applicable, and be sure to make timely payments moving forward.

Just because you have been told by a big lender that you’re not eligible doesn’t mean there aren’t other options worth looking into. It may just be that they have an overlay that doesn’t allow them to go below a certain score. FHA actually allows you to have as low as 500 score, although most big lenders don’t do them below 620 score.

How we make money

The more you build up your credit, the more likely it is that you’ll start to qualify for better offers. Because you might have a better chance at getting approved for a store credit card with poor credit. The potential downside is that these cards tend to come with high interest rates, and you may only be able to use them at a specific store.

If you find a lender that says you are qualified with a 580 credit score, this is the better option to choose than an FHA loan. You can buy a house anywhere in the country, and you won’t have to worry about mortgage insurance premiums. Instead of PMI, a VA funding fee is paid at closing, and the amount depends on how many times you’ve availed of the VA loan program.

Can you get a credit card with a 580 credit score?

This may influence which products we write about and where and how the product appears on a page. Credit Karma is committed to ensuring digital accessibility for people with disabilities. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. If you have specific questions about the accessibility of this site, or need assistance with using this site, contact us.

The minimum credit score required to get a conventional loan is 620. Therefore, you would need to wait until your credit score has increased by at least 28 points before you would be eligible for a conventional loan. The lenders featured above all offer mortgage loans to borrowers with a 580 credit score.

This will help you build credit as long as you’re making your payments — but just as with a personal loan, if you miss payments, it will negatively affect your credit. As you catch up on late payments and rebuild your credit, you can improve your situation and perhaps refinance your loan later, with a different lender, at a lower rate. PMI rates can be anywhere from 0.25% to 2% of the loan balance annually, and that percentage is affected in part by your credit score. Pay down your balances and keep your credit utilization under 30%.

However, some lenders only consider the lower of the two credit scores on an application. So make sure you shop around and ask about different lenders’ policies. This is unlikely, as most lenders require a credit score in the 600s or higher for a home equity loan. You may find exceptions if you have a very low debt-to-income ratio and lots of equity. A home equity loan is a second mortgage that’s secured by the value of your home.

But they will look at your payment history and your current debt load as they appear on your credit report. As mention earlier, getting a secured credit card is a great way to establish credit. Secured credit cards work much the same as unsecured credit cards.

The lowest credit score that will qualify you for a mortgage depends on the type of home loan you use and the lender you apply to. They're also available to borrowers with lower credit scores. It is true that most lenders want to see a minimum credit score of 640 before approving VA loans. HomePromise is a VA lender that may approve your VA loan even with a lower credit score. If your credit could use some work, it’s especially important to shop around to find the best deal for you.

So if your security deposit is, say, $300, your credit limit may also be set at $300. This gives the issuer some insurance in case you close the account without paying off your debt. Your payment history is an important factor for your credit scores. Paying on time, every time on accounts that report to the three main consumer credit bureaus can help you build a positive payment history. In this article, we’ll show you how important credit information can influence your credit scores.

Don’t apply for too many credit accounts or too much credit in a short period of time. Having different kinds of credit could increase your chances of building your credit score. Regardless of your current credit score, there are steps you can take that could knock each of these categories into shape and begin rebuilding your credit. Of course, you also want to focus on making timely payments from here on out. It’s important to know which factors make up your credit score.

USDA and VA loans are government-backed options without credit score minimums, but most lenders prefer a credit score of at least 640 and 620, respectively. To qualify for a no-down-payment mortgage through a commercial or private lender, you’ll likely need excellent credit. But you’d have to pay for private mortgage insurance as well. If you can get your score up to 620, you might qualify for a conventional loan or VA loan. Similar to USDA loans, they don’t exactly ask for a minimum credit score for VA loans.

No comments:

Post a Comment